Bookkeeper vs QuickBooks Live for June 2024 Bookkeeping Services

To delve deeper into our best small business accounting software, we tested and used each platform to evaluate how the features perform against our metrics. This hands-on approach helps us strengthen our accounting software expertise and deliver on the Fit Small Business mission of providing the best answers to your small business questions. QuickBooks Online Plus adds essential business tools like inventory tracking and project management. Intuit QuickBooks Online has four plans that can accommodate small, midsize and large businesses. New users can choose between a 30-day free trial or a three-month 50% discount.

How much does a bookkeeper cost for a small business?

This software is best suited for freelancers, allowing them to track income and expenses, track mileage, estimate quarterly taxes, and run basic reports. When it seems like there is a business software application for everything, it pays to be choosy. QuickBooks Online payroll costs between $45-$125/month plus $6-$10/month per employee. If your small business needs a payroll solution, be sure to add this cost to the regular QuickBooks Online monthly fee. Read our complete QuickBooks Online Payroll review for the details, and be sure to visit the QBO website to see if Intuit is running a QuickBooks payroll discount before buying.

Make paycheck corrections after payroll

QuickBooks Live Bookkeeping offers online bookkeeping services that connect small businesses with trusted, QuickBooks-certified virtual bookkeepers. QuickBooks Online Essentials costs an additional $25 per month, which adds features like bill management and time tracking. Unlike QuickBooks Simple Start, which includes access for one user and their accountant, Essentials allows you to add up to three users (plus your accountant). Based on the average salary of a bookkeeper, you should be paying roughly $3,516 a month for bookkeeping if you choose to hire a bookkeeper.

Automatic income and expense tracking

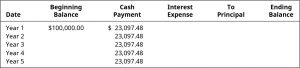

Once they have all the required information, they’ll start cleanup, which include categorizing transactions and reconciling accounts. Cleanup takes about 30 days from the time they receive everything they need from you. QuickBooks Live’s pricing is based on the company’s average monthly expenses and ranges from $300 to $700 a month after the initial month of service. The cost for the initial month will include an additional https://www.accountingcoaching.online/standard-costing-accountingtools/ charge for onboarding and cleanup, but the exact amount is custom-priced for each customer. Complete Training and Live Help MembershipTo refund your membership, please send an email to [email protected] before the 30th day of purchase, and you’ll receive a full refund. Please note if you use any of the included QuickBooks Certification vouchers, we have to deduct the cost of the vouchers ($125 each) from your refund.

- Most integrations come with monthly subscription fees, so be sure to account for these extra costs when calculating your total costs for QBO.

- Features that are not included in the self-employed plan, but are available with the Simple Start plan, include sales and sales tax tracking, 1099 contractor management, and the ability to create and send estimates.

- A key added feature of the QuickBooks Essentials plan is the ability to manage unpaid bills and allocate billable time and expenses to a specific customer.

- If you have five employees who need to track time and only two who need access to other features in the software, you can still use the Essentials plan without upgrading to the Plus plan.

Related Bookkeeping Service Reviews

If you’ve already registered for the test or taken the test before 30 days and requested a refund, we will deduct the cost of the voucher ($125) from your refund. The best QuickBooks Online plan for you depends on the size of your business and your particular needs. If you deal with inventory or large projects heavily, Plus is the best option.

Its basic features include invoicing, online payment acceptance, 1099 contractor management and automatic sales channel syncing (for e-commerce business owners). NerdWallet’s accounting software ratings favor products that are easy to use, reasonably priced, have a robust feature set and can grow with your business. The best accounting software received top marks when evaluated across 10 categories and more than 30 subcategories. These few accounting products fell short in our ratings rubric on a number of fronts. We recommend skipping them in your exploration of the best accounting software for small businesses, unless you can live without some key features these products lack and their price tag feels worth it to you.

Besides that, QuickBooks Online also has a lot of special reports that you can generate, like a balance sheet and P&L statement by class or location. It’s our best small business accounting software because of its versatility. Upon enrollment, you’ll be assigned a dedicated bookkeeper who’ll collaborate with you virtually. If your business is service-based without any inventory, then Essentials should provide everything you need while saving you $30 per month compared to Plus.

Xero does not offer a mobile app, so Bookkeeper360 users should choose QuickBooks Online as their software if they want mobile accounting. Online bookkeeping services can also be more cost-effective than traditional bookkeeping methods. They eliminate the need for businesses to invest in expensive accounting software or hire in-house accountants, since all the necessary tools and expertise are available online. This can be particularly beneficial for small businesses and startups with limited budgets. QuickBooks Live Bookkeeping is real-time, live bookkeeping support from a QuickBooks-certified bookkeeper (also known as a QuickBooks ProAdvisor).

Xero’s plans cost $13, $37, and $70 per month, compared to the QuickBooks $20, $30, and $60 per month plans. However, the “Secure” brand of checks offer in-depth fraud protection measures that may justify the price, provided you anticipate security risks at your business. Also available from the service is a lending program called QuickBooks Capital. Those with QuickBooks Online accounts are https://www.business-accounting.net/ potentially eligible, though they’ll still need to qualify on the strength of their accounting history. Similarly, you can create a client database and track overdue client payments to keep on top of who owes you what. If you want to give QuickBooks a try before buying, you can sign up for a free 30-day trial or use the company’s interactive test drive that’s set up with a sample company.

Additionally, it enables you to record and track payments made to 1099 contractors. QuickBooks offers more — and better — reports than nearly any other accounting software provider. With the Simple Start plan, QuickBooks’ software will generate cash flow statements, income statements and balance sheets.

It also has excellent reporting features and a capable mobile app as well as a customizable dashboard that lets each user rearrange or hide panels according to their preferences. With QuickBooks Live Expert Full-Service Bookkeeping, a dedicated bookkeeper will get to know your business, bring your past what is stock split pros and cons books up to date, and do your book for you, start to finish. Bookkeeper.com charges anywhere from $399 to $799 per month, depending on the number of monthly transactions, frequency of service, and annual revenue. Neither QuickBooks Live nor Bookkeeper.com currently offers a dedicated mobile app.